Introduction to Global Controversies

Global controversies refer to significant events or issues that provoke widespread debate, outrage, or interest across various societies, often transcending national borders. These scandals can originate in diverse realms—politics, business, sports, or culture—but they share a common thread: the ability to challenge established norms and provoke critical discussions on ethical, social, and moral grounds. Understanding these controversies is essential as they frequently reshape public opinion and influence the course of history.

One of the primary reasons scandals matter lies in their capacity to unveil systemic flaws and injustices within societies. They often shine a light on corruption, inequality, or misconduct, prompting calls for accountability and change. For instance, high-profile political scandals can lead to a loss of trust in governing bodies, fundamentally altering the relationship between citizens and their leaders. Similarly, controversies linked to corporations can lead to increased scrutiny on corporate governance and ethical practices, thus impacting consumer behavior and market dynamics.

The role of media in amplifying global controversies cannot be overlooked. With the advent of digital platforms and social media, information spreads rapidly, enabling public discourse to thrive. News outlets have a duty to investigate and report on scandals, but this reporting can also create sensationalism, sometimes distorting the public’s understanding of the events. Coverage of global controversies shapes narratives that influence societal attitudes and perceptions, making it vital to approach such information with a critical mindset.

In the following sections, we will delve deeper into ten significant scandals that have left a profound impact on society, politics, and cultural conversations around the globe. These events not only highlight the issues at hand but also encourage reflection on the underlying values and principles that govern human interaction.

These ten scandals were not merely headline-grabbers; they were turning points that changed laws, public opinions, and international relations.

1. The Watergate Scandal (1972-1974)

The Watergate Scandal, unfolding between 1972 and 1974, is one of the most infamous political scandals in U.S. history. It began as a seemingly simple break-in but evolved into a complex web of deception that ultimately led to the resignation of President Richard Nixon. Here’s an in-depth look at the origins, investigation, and impact of Watergate.

The Watergate scandal traces back to the re-election campaign of President Richard Nixon. In 1972, Nixon was running for a second term in office under the slogan of “law and order,” promoting a strong, authoritative stance amid a politically divided America. However, his re-election team, known as the Committee to Re-Elect the President (often mockingly referred to as “CREEP”), was determined to secure his victory by any means necessary.

On June 17, 1972, five men were caught breaking into the Democratic National Committee (DNC) headquarters at the Watergate office complex in Washington, D.C. Their objective was to wiretap phones and steal documents related to the Democratic Party’s election strategy. Although this break-in could have been seen as a minor incident, journalists and authorities began to uncover a much larger story involving high-level cover-ups and abuses of power.

The Investigation Begins

Following the arrests, two journalists from The Washington Post, Bob Woodward and Carl Bernstein, began investigating the break-in. Their work initially received little attention but quickly grew in importance as they uncovered connections between the burglars and key figures in Nixon’s administration. They learned that Nixon’s aides had orchestrated the burglary and that high-ranking officials were involved in attempts to sabotage the Democratic Party.

With the support of their anonymous source, famously known as “Deep Throat” (later revealed to be FBI Associate Director Mark Felt), Woodward and Bernstein’s reporting played a significant role in uncovering the scope of the conspiracy. They revealed that the Nixon administration had engaged in widespread surveillance and other illegal activities aimed at consolidating political power. Meanwhile, the FBI’s investigation, combined with Congress’ own probe, unearthed more information about a cover-up that extended deep into the White House.

The White House Tapes and the Supreme Court Decision

In the summer of 1973, it was revealed that President Nixon had a secret recording system in the Oval Office, which had recorded all conversations. The existence of these tapes was a turning point in the investigation, as they provided concrete evidence of the President’s involvement in the Watergate cover-up. However, Nixon refused to release the tapes, citing executive privilege, and the case escalated to the U.S. Supreme Court.

In a landmark decision in July 1974, the Supreme Court ruled unanimously in United States v. Nixon that the President must hand over the tapes. The tapes contained incriminating conversations, including one known as the “smoking gun” tape, which showed that Nixon had attempted to halt the FBI investigation by instructing his staff to direct the CIA to intervene—a clear abuse of presidential power.

Resignation of President Nixon

Facing almost certain impeachment, Nixon’s support within his own party dwindled. In a televised address on August 8, 1974, Nixon announced his resignation, becoming the first U.S. president to do so. His resignation marked the climax of the Watergate scandal and avoided a lengthy impeachment trial in Congress. The following day, Vice President Gerald Ford was sworn in as President and famously granted Nixon a full pardon, a decision that remains controversial and debated to this day.

Aftermath and Impact on American Politics

The impact of Watergate was profound, shaking the American people’s faith in their government. It exposed a level of corruption at the highest level of U.S. politics that many found shocking and led to widespread distrust in government institutions and elected officials.

The scandal also led to several significant changes in American law and politics:

- Campaign Finance Reform

- The Freedom of Information Act (FOIA)

- The Ethics in Government Act

- Rise of Investigative Journalism

- Lasting Distrust in Government

2. The Panama Papers Leak (2016)

The Panama Papers Leak, revealed in April 2016, exposed a vast network of global tax evasion and financial secrecy involving world leaders, politicians, celebrities, business figures, and criminals. The scandal centered on a leak of 11.5 million documents from the Panamanian law firm Mossack Fonseca, obtained by German newspaper Süddeutsche Zeitung and analyzed by the International Consortium of Investigative Journalists (ICIJ). The documents detailed over 214,000 offshore entities and secret accounts that were used to conceal assets, evade taxes, and, in some cases, launder money.

Background and Revelation

Mossack Fonseca was one of the largest providers of offshore financial services, specializing in creating shell companies in tax havens such as Panama, the British Virgin Islands, and the Bahamas. While offshore accounts are not necessarily illegal, the leak revealed how they were often used by wealthy individuals and public officials to shield assets from taxation and scrutiny. The documents included records dating back to the 1970s and implicated influential figures worldwide, including:

- Heads of State and Politicians: The leak identified connections to high-ranking officials from over 50 countries, including Iceland’s Prime Minister Sigmundur Davíð Gunnlaugsson, the family of Pakistan’s then-Prime Minister Nawaz Sharif, and associates of Russian President Vladimir Putin.

- Celebrities and Business Figures: The papers included celebrities like Argentine soccer star Lionel Messi and individuals from Fortune 500 companies, many of whom used offshore accounts for personal and corporate financial gains.

- Criminal Networks: Some entities revealed connections to money laundering operations, drug cartels, and arms traffickers, highlighting the role of shell companies in supporting illegal activities.

Global Reaction and Fallout

The Panama Papers created a media frenzy and led to immediate public outcry. In Iceland, protests erupted following the revelation of Gunnlaugsson’s undisclosed offshore holdings, forcing him to resign. Similarly, Pakistan’s Supreme Court disqualified Nawaz Sharif from office due to the findings.

Many countries launched investigations into tax evasion and money laundering based on the leaked information. In the U.K., France, Australia, and Canada, tax authorities began reviewing the financial activities of citizens implicated in the papers. The scandal also prompted new legislative action to improve financial transparency, with governments enforcing stricter regulations on financial disclosures and tax reporting.

Impact on Financial Regulation and Offshore Banking

The Panama Papers amplified scrutiny on offshore banking and tax havens, accelerating calls for international reforms. The leak influenced new policies aimed at combating tax evasion, such as the EU’s Anti-Tax Avoidance Directive, and strengthened existing measures like the Common Reporting Standard (CRS), which improved information-sharing among tax authorities worldwide. Banks and financial institutions were also pressured to improve compliance with anti-money laundering (AML) standards and know-your-customer (KYC) protocols.

Long-Term Consequences and Legacy

The Panama Papers marked a turning point in global awareness of financial secrecy and its abuse by elites. They sparked public debate on wealth inequality, tax fairness, and the ethics of using offshore accounts. The leak underscored the power of investigative journalism, particularly in exposing complex financial schemes that often go unnoticed by regulators.

While the Panama Papers did not eradicate offshore banking, they paved the way for further investigations and more stringent global regulations, making it harder for individuals and corporations to use tax havens to avoid scrutiny.

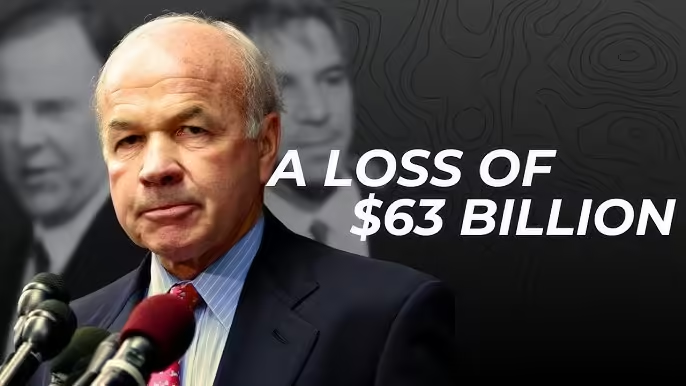

3. The Enron Scandal (2001)

The Enron scandal of 2001 was one of the largest and most notorious corporate fraud cases in history, leading to the bankruptcy of Enron Corporation, a major American energy company, and the dissolution of Arthur Andersen, one of the world’s largest auditing firms. The scandal exposed a widespread culture of corporate greed, unethical accounting practices, and regulatory failures, which shook investor confidence in the corporate world and led to significant regulatory reforms.

Background of Enron Corporation

Founded in 1985, Enron rapidly grew from a regional energy company into a global energy and commodities trading giant. By the late 1990s, it was celebrated for its innovation and profitability, earning praise for pioneering energy trading and market-based solutions. Enron expanded into various sectors, including natural gas, electricity, and even internet bandwidth, and was lauded as one of the most innovative companies in America.

However, beneath its success was a web of complex financial maneuvers designed to inflate revenue, hide debt, and create the illusion of profitability. Enron’s executives were driven by a relentless focus on stock prices and aggressive growth targets, which ultimately led to their downfall.

The Fraudulent Accounting Practices

Enron’s collapse was primarily due to a series of fraudulent accounting techniques designed to make the company appear far more profitable than it was. Some of the most critical components of this fraud included:

- Special Purpose Entities (SPEs): Enron created hundreds of special purpose entities (also known as SPEs or “off-balance-sheet” partnerships) to transfer debt and avoid recording it on its own balance sheet. These entities helped Enron appear financially healthy by hiding billions of dollars in debt, creating an artificial impression of high profits and financial stability.

- Mark-to-Market Accounting: Enron employed an accounting method known as mark-to-market, which allowed the company to book potential future profits from long-term contracts as immediate revenue. In many cases, Enron recorded profits on projects before they even generated revenue, inflating income statements and misleading investors about the company’s real financial performance.

- Complex Financial Instruments: Enron’s finance department created highly complicated financial instruments, including derivatives and hedging transactions, to obscure the company’s true liabilities. Many of these instruments were poorly understood by both investors and some Enron executives, allowing the company to deceive stakeholders more effectively.

These accounting methods enabled Enron to report exponential growth and profitability while hiding its financial problems. Top executives, including CEO Jeffrey Skilling and CFO Andrew Fastow, were well aware of these practices and played a central role in perpetuating the fraud.

The Role of Arthur Andersen

Arthur Andersen, Enron’s auditor, played a crucial role in the scandal by failing to report or question Enron’s unethical accounting practices. The firm approved Enron’s financial statements and did not disclose the company’s reliance on SPEs or its questionable use of mark-to-market accounting. Arthur Andersen also provided consulting services to Enron, which created conflicts of interest and contributed to the lack of oversight.

When the scandal broke, Andersen was found to have shredded documents related to its audits of Enron. This action was deemed an obstruction of justice, and Arthur Andersen eventually faced criminal charges, leading to the firm’s collapse and the loss of its clients.

The Scandal Unravels

In 2001, concerns about Enron’s financial practices started to surface when journalist Bethany McLean of Fortune magazine published an article questioning how Enron made its money and managed its finances. Following further scrutiny, Enron disclosed that it had overstated its earnings by nearly $600 million over several years. The company’s stock price began to plummet, and investors lost confidence in Enron’s ability to repay its massive debts.

As investigations deepened, the true extent of Enron’s fraudulent activities came to light. The U.S. Securities and Exchange Commission (SEC) and Congress launched inquiries, and by December 2001, Enron filed for bankruptcy, marking the largest bankruptcy in U.S. history at the time. Investors, including employees with retirement funds tied up in Enron stock, lost billions of dollars.

Legal Proceedings and Convictions

The Enron scandal led to multiple lawsuits and criminal charges against top executives. Jeffrey Skilling, the former CEO, was convicted of securities fraud, insider trading, and other charges, and sentenced to 24 years in prison (later reduced to 14 years). Andrew Fastow, the CFO who masterminded many of the fraudulent schemes, cooperated with investigators and received a six-year prison sentence. Ken Lay, Enron’s founder and former chairman, was also convicted but passed away before his sentencing.

Arthur Andersen was convicted of obstructing justice for shredding Enron-related documents. Although the conviction was later overturned on appeal, the firm’s reputation was irreparably damaged, leading to its dissolution.

Impact on Corporate Governance and Regulations

The Enron scandal had far-reaching effects on corporate governance, investor protection, and regulatory oversight. It highlighted severe flaws in accounting practices and conflicts of interest within the corporate and financial sectors, leading to significant regulatory reforms, most notably:

- The Sarbanes-Oxley Act of 2002: In response to Enron and similar scandals, Congress enacted the Sarbanes-Oxley Act (SOX) to enhance corporate accountability and protect investors. SOX imposed strict regulations on financial reporting, required companies to implement internal controls, and established the Public Company Accounting Oversight Board (PCAOB) to oversee auditors.

- Increased Transparency and Accountability: The scandal prompted a push for increased transparency in corporate financial reporting. Companies are now required to provide more detailed disclosures and are held accountable for the accuracy of their financial statements.

- Stricter Oversight of Auditors: SOX imposed new requirements on audit firms to ensure their independence and prevent conflicts of interest. The Act restricted auditors from providing certain consulting services to their audit clients to reduce incentives to overlook misconduct.

4. Volkswagen Dieselgate (2015)

The Volkswagen emissions scandal, popularly known as Dieselgate, erupted in September 2015 and quickly became one of the most significant corporate scandals in automotive history. Here’s a detailed look at the events, implications, and repercussions of the scandal.

Volkswagen Group (VW), a German automobile manufacturer, was founded in 1937 and became one of the world’s largest automotive companies. By the 2000s, the company was pushing to become the world’s largest automaker and promoted its diesel vehicles as environmentally friendly, promising low emissions and fuel efficiency. The marketing campaign for VW’s “clean diesel” technology targeted environmentally conscious consumers and was positioned as a solution to reducing greenhouse gas emissions.

The Discovery

In May 2014, the International Council on Clean Transportation (ICCT) conducted independent emissions tests on diesel vehicles and found discrepancies between laboratory test results and real-world emissions. This led to further investigation, culminating in the U.S. Environmental Protection Agency (EPA) issuing a notice of violation to Volkswagen on September 18, 2015.

The Defeat Devices

The scandal centered around the use of defeat devices—software installed in the engine control units of VW’s diesel cars. These devices detected when the vehicle was undergoing emissions testing and altered the engine performance to comply with emissions standards. In normal driving conditions, however, the vehicles emitted nitrogen oxides (NOx) at levels significantly exceeding the legal limits.

Key points about the defeat devices include:

- Engine Performance Manipulation: When a vehicle was under testing conditions, the software would switch the engine to a mode that reduced emissions. Outside of the test, the vehicle operated in a way that emitted up to 40 times the permissible limits of NOx.

- Affected Models: Approximately 11 million vehicles worldwide were implicated, including popular models such as the VW Jetta, Passat, Golf, Audi A3, and Porsche Cayenne.

Corporate and Legal Repercussions

The scandal led to immediate and far-reaching consequences for Volkswagen:

- Leadership Changes: Shortly after the scandal broke, VW’s CEO Martin Winterkorn resigned. He later faced criminal charges, including fraud and conspiracy.

- Legal Actions: Volkswagen faced numerous lawsuits from consumers, environmental groups, and government agencies. In the United States, the company agreed to a staggering $25 billion settlement in 2016. This included compensation for vehicle buybacks, environmental remediation, and funding for clean technology initiatives.

- Regulatory Scrutiny: The scandal prompted a review of emissions testing procedures worldwide. Governments and regulatory bodies tightened regulations to prevent similar incidents, leading to increased oversight of the automotive industry.

Financial Impact

The financial fallout from Dieselgate was significant:

- Stock Price Drop: VW’s stock price plummeted after the scandal was revealed, leading to billions in losses. The company lost approximately $66 billion in market value within months of the announcement.

- Fines and Settlements: VW was subject to various fines and settlements globally, including substantial penalties from the EPA and other environmental agencies.

Rebuilding Trust

In the aftermath of the scandal, Volkswagen sought to rebuild its brand and regain consumer trust:

- Commitment to Electric Vehicles: VW announced plans to shift its focus from diesel to electric vehicles (EVs), investing heavily in EV technology. The company committed to launching a range of electric models, with a goal to become a leader in the EV market.

- Cultural Changes: VW began implementing changes to its corporate culture to promote transparency and accountability, including revising internal practices and enhancing compliance programs.

Broader Implications

The Dieselgate scandal had far-reaching implications beyond Volkswagen:

- Environmental Awareness: The scandal raised public awareness about emissions and the environmental impact of diesel vehicles, leading to increased scrutiny of automakers’ practices.

- Shift in Automotive Industry: The scandal prompted a shift in the automotive industry towards cleaner technologies and alternative fuels, as consumers became more aware of environmental issues.

- Legislative Changes: Dieselgate led to stronger emissions regulations and testing standards in many countries, influencing how vehicles are tested and regulated for compliance with environmental standards.

5. Cambridge Analytica and Facebook Data Scandal (2018)

The Cambridge Analytica and Facebook data scandal, which came to light in 2018, was one of the most significant privacy breaches in recent history, raising concerns about data privacy, social media ethics, and the manipulation of public opinion. Here’s a detailed overview of the events, implications, and repercussions of the scandal.

Cambridge Analytica, a political consulting firm, was established in 2013 as a subsidiary of the data analytics company SCL Group. The firm specialized in using data-driven strategies to influence electoral outcomes and public opinion. It played a prominent role in several political campaigns, including the 2016 United States presidential election and the Brexit referendum in the UK.

Facebook’s Data Collection Practices

Facebook, one of the largest social media platforms in the world, collects vast amounts of personal data from its users. This data is used to target advertisements and content, making it a powerful tool for political campaigns and marketers. Facebook allowed third-party developers to access user data, which enabled the creation of apps that could harvest information from users and their friends.

The Breach

- Data Harvesting: The scandal began with the revelation that Cambridge Analytica had acquired data from approximately 87 million Facebook users without their explicit consent. This was done through a personality quiz app developed by Aleksandr Kogan, a researcher at Cambridge University. The app, titled “This Is Your Digital Life,” collected not only data from users who installed the app but also from their friends, leveraging Facebook’s data-sharing policies at the time.

- Psychographic Profiling: Cambridge Analytica used the harvested data to create detailed psychographic profiles of voters. This allowed them to target individuals with tailored political advertisements based on their interests, behaviors, and psychological traits, influencing their voting decisions.

- Political Campaigns: The data was employed in various political campaigns, most notably in the 2016 U.S. presidential election to support Donald Trump’s campaign, as well as the Brexit campaign advocating for the UK to leave the European Union. The firm claimed to have successfully influenced voter behavior through targeted messaging.

The Scandal Unfolds

The scandal came to public attention in March 2018, following investigations by journalists and the reporting of whistleblowers, including former Cambridge Analytica employee Christopher Wylie. Wylie revealed how the firm had manipulated data to influence elections and highlighted the ethical implications of using personal data without consent.

- Media Coverage: Investigative reports from outlets like The Guardian and The New York Times detailed how Cambridge Analytica exploited Facebook’s data policies. The revelations sparked outrage over privacy violations and the ethical implications of data use in political campaigning.

- Facebook’s Response: In response to the scandal, Facebook CEO Mark Zuckerberg faced intense scrutiny. He testified before the U.S. Congress in April 2018, addressing the company’s data privacy practices and the need for stricter regulations. Facebook also implemented changes to its data access policies, limiting third-party access to user data and increasing transparency regarding data usage.

Legal and Regulatory Consequences

The Cambridge Analytica scandal prompted a series of legal and regulatory actions:

- Investigations: Several investigations were launched by authorities in the U.S., UK, and other countries. The Federal Trade Commission (FTC) in the U.S. began an investigation into Facebook’s data practices, while the UK’s Information Commissioner’s Office (ICO) scrutinized both Cambridge Analytica and Facebook.

- Fines and Settlements: In July 2019, Facebook was fined $5 billion by the FTC for violating users’ privacy and misleading them about how their data was used. The settlement also mandated Facebook to implement a new privacy framework.

- Cambridge Analytica Closure: Following the scandal, Cambridge Analytica ceased operations in May 2018, declaring bankruptcy amid mounting legal fees and reputational damage.

Implications for Data Privacy

The scandal had significant implications for data privacy and the regulation of social media platforms:

- Public Awareness: The revelations increased public awareness about data privacy issues, prompting users to reconsider the information they share on social media and the implications of that data being used for targeted advertising.

- Regulatory Changes: Governments worldwide began to explore stricter regulations regarding data protection. The scandal contributed to the passage of laws like the General Data Protection Regulation (GDPR) in the EU, which aimed to enhance data privacy rights for individuals.

- Ethical Concerns: The scandal raised ethical concerns about the manipulation of data for political purposes, leading to discussions about the responsibilities of social media companies and the need for transparency in political advertising.

6. The Catholic Church Sexual Abuse Scandal (2000s)

The Catholic Church sexual abuse scandal, particularly prominent in the 2000s, involved widespread allegations of sexual abuse by priests and the systemic cover-up of these abuses by church officials. This scandal had profound implications for the Catholic Church, its members, and the broader society, leading to significant legal, financial, and cultural repercussions. Here’s a detailed overview of the scandal:

The roots of sexual abuse within the Catholic Church date back decades, if not centuries, but it was in the early 2000s that these issues gained widespread public attention. The church faced numerous allegations of sexual misconduct by priests, particularly involving minors. Many victims reported that their experiences had been silenced, often due to a culture of secrecy and protection within the church hierarchy.

Key Events in the 2000s

- The Boston Globe Investigation (2002): A pivotal moment occurred in January 2002 when the Boston Globe published a series of investigative articles revealing that the Archdiocese of Boston had covered up allegations of sexual abuse by priests. The investigation, led by the newspaper’s Spotlight team, uncovered evidence that church officials, including Cardinal Bernard Law, had been transferring abusive priests to different parishes rather than reporting them to the authorities or providing support to victims. This reporting prompted a public outcry and led to further investigations worldwide.

- Public Accusations and Lawsuits: Following the Boston Globe’s revelations, numerous victims came forward with accusations against priests in various dioceses across the United States and other countries. Many filed lawsuits against the church, alleging that it had failed to protect them and had actively covered up the abuses. The church faced thousands of civil lawsuits during this period.

- The 2004 John Jay Report: In 2004, the John Jay College of Criminal Justice released a comprehensive study commissioned by the U.S. Conference of Catholic Bishops (USCCB). The report found that approximately 4,392 priests were accused of sexually abusing minors between 1950 and 2002, and it estimated that more than 10,000 victims had come forward. The report highlighted the widespread nature of the problem and the church’s failure to address it adequately.

- Pope Benedict XVI’s Response: In April 2005, Pope John Paul II passed away, and Cardinal Joseph Ratzinger became Pope Benedict XVI. During his papacy, Benedict sought to address the sexual abuse crisis, expressing remorse and implementing some measures to improve accountability. In 2010, he stated that the church had made “serious mistakes” in handling abuse cases, but critics argued that his actions fell short of the necessary reforms.

- The Irish Abuse Scandal: The scandal extended beyond the United States. In 2009, a report revealed widespread abuse in Ireland, involving both clergy and church officials covering up the abuse. The Ryan Report detailed the abuse of children in residential schools run by the church, leading to public outrage and calls for accountability.

Legal and Financial Repercussions

- Bankruptcy Filings: Many dioceses in the United States faced financial ruin due to the costs associated with legal settlements. In 2004, the Archdiocese of Portland became the first diocese to file for bankruptcy protection, followed by others, including the Archdiocese of San Diego and the Diocese of Spokane. Bankruptcy proceedings allowed these dioceses to reorganize their finances while dealing with numerous claims from victims.

- Compensation Funds: To address the flood of lawsuits, some dioceses established compensation funds for victims. In 2007, the Diocese of Los Angeles announced a $660 million settlement for over 500 victims, marking one of the largest settlements in church history. Other dioceses followed suit, attempting to provide some financial compensation while avoiding lengthy court battles.

- Legislation Changes: The scandal prompted changes in laws regarding the reporting of child abuse. Several states in the U.S. passed legislation to extend statutes of limitations for victims to file civil suits against their abusers and the institutions that harbored them.

Cultural and Societal Impact

- Loss of Trust: The scandal led to a significant erosion of trust in the Catholic Church among its members and the broader public. Many congregants questioned the church’s moral authority and leadership.

- Calls for Reform: The widespread nature of the abuse and the church’s handling of allegations spurred calls for reforms within the institution. Advocates for victims urged the church to adopt more stringent policies regarding the reporting and handling of abuse allegations, as well as greater transparency and accountability.

- Formation of Advocacy Groups: Numerous advocacy groups emerged in response to the crisis, supporting survivors and advocating for justice. Organizations like Survivors Network of those Abused by Priests (SNAP) worked to provide resources for victims and push for legal reforms.

7. The Iran-Contra Affair (1980s)

The Iran-Contra Affair was a political scandal in the United States during the 1980s that involved secret and illegal activities conducted by the Reagan administration. The affair encompassed two main elements: the covert sale of arms to Iran, which was under an arms embargo, and the diversion of proceeds from those sales to fund Contra rebels in Nicaragua, despite congressional prohibition. Here’s a detailed overview of the affair, its origins, key events, and consequences.

Background

In the 1980s, several geopolitical issues influenced U.S. foreign policy:

- Iran-Iraq War: Between 1980 and 1988, Iran and Iraq were engaged in a brutal war. The U.S. initially supported Iraq but later sought to improve relations with Iran in hopes of securing the release of American hostages held by Hezbollah in Lebanon, a group with ties to Iran.

- Nicaragua and the Contras: In Nicaragua, the Sandinista government, a leftist regime supported by the Soviet Union, was in power. The U.S. government was concerned about the spread of communism in Central America and sought to undermine the Sandinistas by supporting the Contras, a rebel group fighting against the Sandinista regime. However, in 1984, Congress passed the Boland Amendment, which prohibited U.S. assistance to the Contras, making it illegal to fund the rebel group.

Key Events of the Iran-Contra Affair

- Secret Arms Sales: In 1985, the Reagan administration, believing that improving relations with Iran could help secure the release of American hostages held in Lebanon, authorized a secret operation to sell arms to Iran. The U.S. hoped to leverage these arms sales to gain influence over Iran and facilitate the release of the hostages.

- Diverting Funds to the Contras: The arms sales were successful, and significant profits were generated. In direct violation of the Boland Amendment, senior officials in the Reagan administration decided to divert these proceeds to fund the Contras in Nicaragua. This decision was made without the knowledge or approval of Congress.

- Exposure of the Affair: The Iran-Contra Affair began to unravel in late 1986 when a Lebanese newspaper reported on the arms sales to Iran. Subsequently, investigations were launched, and it was revealed that a significant portion of the funds had indeed been funneled to the Contras.

Investigations and Revelations

- Congressional Hearings: In 1987, Congress conducted hearings to investigate the Iran-Contra Affair. Key figures in the administration, including National Security Adviser John Poindexter and Lieutenant Colonel Oliver North, were called to testify. During the hearings, it was revealed that North had played a central role in facilitating the arms sales and the diversion of funds to the Contras.

- Special Prosecutor Investigation: Following the hearings, a special prosecutor, Lawrence Walsh, was appointed to investigate the affair further. The investigation uncovered extensive documentation of the administration’s activities, including meetings and communications that indicated a coordinated effort to circumvent congressional restrictions.

- Findings and Indictments: The investigation led to the indictment of several senior officials in the Reagan administration. Oliver North was convicted on charges related to the scandal, though his convictions were later vacated on appeal. Other officials, including Poindexter, faced various legal consequences.

Consequences

- Political Fallout: The Iran-Contra Affair had significant political repercussions for the Reagan administration. It raised questions about executive power and accountability, as many lawmakers and citizens were outraged by the administration’s disregard for congressional authority.

- Public Perception: The scandal damaged the credibility of the Reagan administration, leading to decreased public trust in government institutions. It also contributed to a broader skepticism about U.S. foreign policy and military interventions.

- Policy Changes: In the wake of the scandal, Congress took steps to increase oversight of covert operations and foreign military aid, implementing stricter regulations to prevent similar abuses of power in the future.

- Legacy: The Iran-Contra Affair remains a significant chapter in U.S. political history, often cited as an example of executive overreach and the complexities of U.S. foreign policy during the Cold War. The affair influenced subsequent discussions about accountability and transparency in government operations.

8. The Libor Rate-Rigging Scandal (2012)

The LIBOR rate-rigging scandal, which came to light in 2012, involved the manipulation of the London Interbank Offered Rate (LIBOR) by several major financial institutions. This scandal raised significant questions about the integrity of financial markets, the role of regulatory bodies, and the practices of major banks. Below is a detailed overview of the LIBOR scandal, its origins, key events, and implications.

LIBOR (London Interbank Offered Rate) is an interest rate that banks use to lend money to each other. It serves as a benchmark for various financial products, including mortgages, loans, and derivatives. LIBOR rates are calculated daily based on the average interest rates submitted by a panel of leading banks, reflecting their estimated borrowing costs.

Origins of the Scandal

The roots of the scandal trace back to the financial crisis of 2008. In the aftermath, many banks faced increased scrutiny and pressure to maintain financial stability. During this period, some banks began to submit artificially low LIBOR rates to present a healthier financial position and to avoid showing the true cost of borrowing, which was significantly higher due to the prevailing economic conditions.

Key Events

- Initial Revelations (2012): The scandal first gained traction in June 2012 when Barclays Bank was fined by British regulators for manipulating LIBOR rates. The Financial Services Authority (FSA), along with the U.S. Commodity Futures Trading Commission (CFTC), uncovered evidence that Barclays had submitted false information regarding its borrowing costs.

- Wider Investigations: Following Barclays’ admission, regulatory authorities in the UK, the U.S., and other countries launched broader investigations into the practices of multiple banks. It was discovered that not only Barclays but also several other major banks, including J.P. Morgan, Citigroup, UBS, and Royal Bank of Scotland, had engaged in similar manipulative practices.

- Manipulation Techniques: Banks were found to have collaborated in manipulating LIBOR rates by coordinating their submissions. Traders within these banks would encourage the submission of lower or higher rates, depending on their trading positions. This manipulation was often conducted to enhance profits or to protect the banks’ reputations during the financial crisis.

- Regulatory Actions: By late 2012, investigations had broadened to include numerous banks. In June of that year, the U.S. Department of Justice (DOJ) and the FSA announced that they were investigating the matter, leading to significant fines and legal consequences for several institutions.

Legal and Financial Consequences

- Fines and Settlements: By the end of 2012, multiple banks faced hefty fines for their involvement in the scandal. Barclays was fined approximately £290 million (around $450 million) by UK and U.S. regulators. Other banks faced similar penalties, with UBS fined around $1.5 billion in December 2012.

- Criminal Charges: Several individuals within the implicated banks faced criminal charges. Notably, in 2018, former traders from various banks were convicted for their roles in the manipulation schemes, receiving various sentences. The scandal also prompted a reevaluation of the personal accountability of bank executives.

- Regulatory Reforms: The LIBOR scandal led to significant changes in the way benchmark rates are set. The UK’s Financial Conduct Authority (FCA) implemented new regulations, emphasizing greater transparency and oversight in the calculation of LIBOR. Additionally, the benchmark itself underwent reforms, with a shift towards transaction-based rates instead of submissions based on estimates.

Implications

- Loss of Trust: The LIBOR scandal severely damaged public trust in major financial institutions and the banking sector as a whole. It raised serious concerns about the ethical practices within banks and the integrity of financial markets.

- Global Impact: The ramifications of the scandal were felt globally, affecting not just the banks involved but also investors, borrowers, and the broader economy. The manipulation of LIBOR rates impacted trillions of dollars in financial contracts and products tied to the rate.

- Cultural Change in Banking: The scandal highlighted the need for a cultural shift within banks, emphasizing ethical behavior, accountability, and the importance of compliance. Many banks began to implement new training programs and compliance measures to address the underlying issues that led to the scandal.

9. Wells Fargo Fake Accounts Scandal (2016)

The Wells Fargo fake accounts scandal, which erupted in 2016, was one of the largest banking scandals in recent history. It involved the creation of millions of unauthorized bank and credit card accounts without customer consent. The scandal raised serious questions about corporate ethics, regulatory oversight, and the culture within the banking industry. Here’s a detailed overview of the scandal, its origins, key events, and consequences.

Wells Fargo & Company, one of the largest banks in the United States, had built its reputation on a foundation of customer trust and community banking. However, the bank’s aggressive sales culture and pressure to meet sales targets led to unethical practices within the organization. Employees were incentivized to sell various financial products, leading to a focus on cross-selling and increasing account numbers, often at the expense of ethical standards.

Key Events of the Scandal

- Unauthorized Account Creation: Beginning as early as 2002 and continuing until 2016, employees of Wells Fargo created millions of unauthorized bank accounts and credit cards. This practice often involved opening accounts using customers’ names without their knowledge or consent, sometimes leading to overdraft fees and damage to customers’ credit scores.

- Pressure and Incentives: The bank’s management established a sales culture that emphasized cross-selling products and achieving aggressive sales targets. Employees faced intense pressure to meet these targets, with some reporting that they were incentivized to engage in unethical practices to avoid repercussions or maintain their jobs. Reports indicated that employees were expected to open multiple accounts for customers, leading to the creation of fake accounts.

- Initial Whistleblowing and Investigation: Concerns about unauthorized account openings began to surface in the early 2010s, primarily through internal whistleblowers. In 2013, the Los Angeles Times published an article detailing complaints from employees regarding the pressure to open unauthorized accounts. However, it was not until 2016 that the scandal gained significant media attention and regulatory scrutiny.

- Regulatory Actions: In September 2016, the Consumer Financial Protection Bureau (CFPB), along with other regulatory agencies, imposed a $185 million fine on Wells Fargo for its illegal practices. The settlement included penalties from the CFPB, the Office of the Comptroller of the Currency (OCC), and the City and County of Los Angeles.

- Public Outcry and Congressional Hearings: The scandal led to widespread public outrage, and Wells Fargo faced significant backlash from customers and stakeholders. In October 2016, former CEO John Stumpf was called to testify before Congress. During the hearings, he faced intense questioning regarding the bank’s practices and the failure of its leadership to prevent the unethical behavior.

Consequences

- Resignation of Key Executives: Following the scandal, John Stumpf resigned as CEO in October 2016. The bank also faced significant turnover in its executive leadership, with the board of directors conducting an internal investigation into the scandal and the culture at Wells Fargo.

- Legal and Financial Repercussions: In addition to the initial fines, Wells Fargo faced numerous lawsuits from affected customers and shareholders. The bank set aside billions of dollars to cover potential legal claims and settlements, leading to a significant financial impact.

- Changes in Corporate Governance: The scandal prompted changes in the bank’s corporate governance and compliance practices. Wells Fargo announced a series of reforms aimed at improving accountability and oversight, including restructuring its sales practices and implementing new training programs to ensure ethical behavior among employees.

- Impact on Reputation: The scandal severely damaged Wells Fargo’s reputation, resulting in a loss of customer trust. Many customers chose to close their accounts and move their business to other banks, leading to a decline in the bank’s customer base.

- Regulatory Scrutiny and Industry Impact: The Wells Fargo scandal led to increased scrutiny of banking practices and regulatory oversight in the industry. Lawmakers and regulators sought to address issues related to corporate governance, sales practices, and consumer protection to prevent similar scandals in the future.

10. Jeffrey Epstein and the Sex Trafficking Scandal (2019)

The Jeffrey Epstein sex trafficking scandal that came to light in 2019 was a complex and shocking case involving allegations of sexual abuse, exploitation, and trafficking of minors. Epstein, a wealthy financier and convicted sex offender, was accused of running a sex trafficking ring that involved powerful individuals from various sectors, including politics, business, and entertainment. Here’s a detailed overview of the scandal, its origins, key events, and its broader implications.

Jeffrey Epstein was born on January 20, 1953, in Brooklyn, New York. He began his career in finance, eventually establishing his own investment firm, J. Epstein & Co., and accumulating significant wealth. Epstein became known for his connections with high-profile individuals, including politicians, celebrities, and royalty. However, beneath this façade of wealth and influence lay a darker reality characterized by allegations of sexual abuse and exploitation.

Early Allegations and Conviction

- First Allegations (2005): The scandal began to take shape in 2005 when the parents of a 14-year-old girl reported to the Palm Beach police that Epstein had sexually abused their daughter. This prompted an investigation into Epstein’s activities, leading to the discovery of multiple victims and allegations of abuse.

- Pleas and Conviction (2008): In 2008, Epstein faced federal charges for soliciting prostitution from a minor. He negotiated a controversial plea deal that resulted in a conviction for felony solicitation of prostitution. Epstein was sentenced to 18 months in jail, of which he served only 13 months in a work-release arrangement that allowed him to leave the jail for up to 12 hours a day. The plea deal, brokered by then-U.S. Attorney for the Southern District of Florida Alexander Acosta, included immunity for any potential co-conspirators.

Renewed Scrutiny and Arrest

- Investigative Reporting (2018): The scandal gained renewed attention in 2018 with the release of the New York Times article detailing Epstein’s history of abuse and the lenient plea deal he received. This prompted further investigations into his activities and connections.

- Arrest (July 2019): On July 6, 2019, Epstein was arrested at Teterboro Airport in New Jersey on federal charges of sex trafficking minors in Florida and New York. Prosecutors alleged that Epstein had operated a sex trafficking ring, luring underage girls to his properties under the guise of providing modeling opportunities, only to sexually exploit them.

Key Events Following Arrest

- Court Proceedings: Epstein pleaded not guilty to the charges. In court documents, prosecutors outlined evidence indicating that Epstein had exploited dozens of girls, some as young as 14, and had established a network of recruiters to facilitate his trafficking operation.

- High-Profile Connections: The scandal was further complicated by Epstein’s connections to numerous high-profile individuals, including former President Bill Clinton, British Prince Andrew, and President Donald Trump. This led to widespread speculation about the extent of Epstein’s connections and the involvement of other powerful figures in his illicit activities.

- Allegations of Co-Conspirators: In addition to Epstein, several women were identified as alleged co-conspirators who helped recruit and groom young girls for Epstein. Prominent among them was Ghislaine Maxwell, a British socialite and Epstein’s former associate, who was accused of playing a significant role in the trafficking scheme.

Death and Aftermath

- Epstein’s Death (August 10, 2019): On August 10, 2019, Epstein was found dead in his jail cell at the Metropolitan Correctional Center in New York City. His death was ruled a suicide by hanging, but it sparked widespread conspiracy theories and speculation regarding the circumstances of his death, given the high-profile nature of his connections and the serious allegations against him.

- Continuing Investigations: Following Epstein’s death, investigations into his activities and connections continued. Law enforcement agencies sought to identify and prosecute any individuals who may have been complicit in his trafficking operations. In July 2020, Ghislaine Maxwell was arrested and charged with multiple counts related to her alleged role in Epstein’s trafficking network.

- Legal Action by Victims: Several women who claimed to be victims of Epstein began to file lawsuits against his estate and associates. In 2020, the estate reached a settlement with many of the victims, providing financial compensation.

Broader Implications

- Discussion on Sex Trafficking: The Epstein scandal brought national and international attention to the issue of sex trafficking, particularly the exploitation of minors. It raised awareness about the complexities of trafficking networks and the challenges in prosecuting perpetrators.

- Regulatory and Legal Reforms: In response to the scandal, there were calls for reforms in how trafficking cases are investigated and prosecuted, as well as increased scrutiny of financial institutions that may have facilitated Epstein’s activities.

- Impact on Institutions: The scandal had a significant impact on various institutions, including law enforcement and legal systems, highlighting potential failures in the handling of previous allegations against Epstein and the need for accountability in prosecuting sex crimes.

Conclusion: Lessons from Global Scandals

Summarize the key lessons learned from these scandals, such as the importance of transparency, accountability, and ethical governance. Highlight how these events have reshaped public expectations and regulatory standards and how they serve as cautionary tales that continue to inform and shape today’s policies and practices.

Each section provides room to delve deeply into each scandal’s unique details, timeline, and consequences, ensuring a comprehensive look at how these events changed everything. Let me know if you’d like to explore any of these sections further!