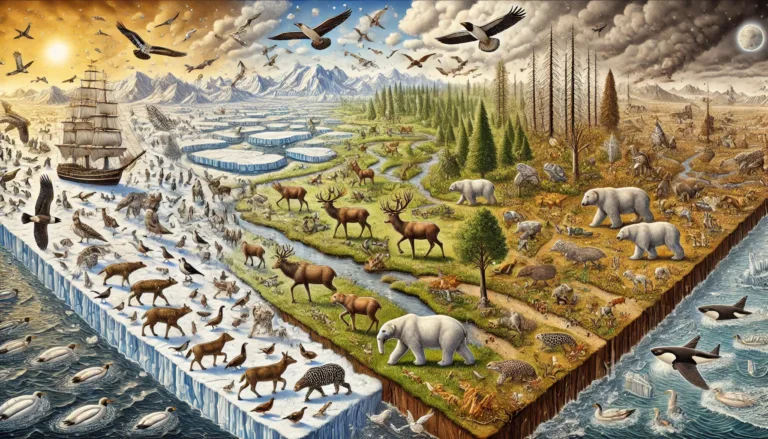

Renewable Energy Trends: The oil and gas industry has been a cornerstone of global energy supply for decades, but as the world shifts towards a more sustainable energy future, renewable energy trends are beginning to reshape the landscape. With increasing concerns over climate change, government regulations, and a growing demand for cleaner energy, oil and gas companies are rethinking their strategies to align with the global transition to renewables.

Introduction to Renewable Energy Trends

The global energy landscape is undergoing a significant transformation, driven by a notable shift towards renewable energy sources. This transition is largely fueled by increasing environmental concerns, technological advancements, and a growing recognition of the need for sustainable energy solutions. Renewable energy trends are becoming critical in shaping not only the energy sector but also the economic and political landscapes worldwide.

As of 2023, data indicates that renewable energy accounted for approximately 29% of the total global energy consumption, with projections suggesting further growth in the coming years. Solar and wind energy, in particular, are experiencing remarkable expansion, with their combined capacity expected to surpass fossil fuel sources by 2025. Hydropower remains a significant contributor, providing more than 15% of global electricity generation. This substantial rise in the adoption of renewable technologies underscores a collective shift towards cleaner, more sustainable energy systems.

Moreover, countries around the world are setting ambitious targets to reduce greenhouse gas emissions, aligning their energy policies with international agreements such as the Paris Accord. For instance, the European Union has pledged to achieve a carbon-neutral economy by 2050, prompting extensive investments in solar, wind, and other renewable technologies. Similarly, nations like China and India are ramping up efforts to expand their renewable energy portfolios, aspiring to increase their installed capacities dramatically in the next decade.

These renewable energy trends are not only significant for environmental sustainability but also play a crucial role in reshaping the oil and gas industry. Traditional energy sectors are feeling the pressure to innovate and adapt, leading to a re-evaluation of business strategies to incorporate renewable alternatives. The trend toward renewables signals a pivotal shift that has far-reaching implications for the future of energy production and consumption globally.

1. Investment in Renewable Energy Projects

Many major oil and gas companies, including Shell, BP, and TotalEnergies, are diversifying their portfolios by investing in renewable energy sources such as wind, solar, and hydrogen. This shift is not just a strategic move to stay relevant, but also a recognition that renewable energy has become a viable and profitable part of the global energy mix. By integrating renewables into their business models, oil and gas companies are preparing for a future where fossil fuels may no longer dominate.

2. Transition to Low-Carbon Technologies

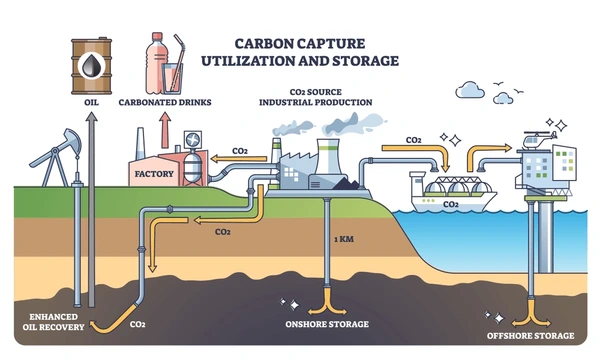

Oil and gas companies are increasingly investing in low-carbon technologies such as carbon capture and storage (CCS) and carbon offsets. These technologies allow companies to reduce their carbon footprint and comply with strict environmental regulations while continuing to produce fossil fuels. CCS, in particular, has gained attention as a key technology for reducing emissions from natural gas and oil production, especially in regions where the energy transition is slower.

3. Collaboration Between Oil, Gas, and Renewable Energy Sectors

As renewable energy scales up, oil and gas companies are finding ways to collaborate with renewable energy providers. Joint ventures between traditional energy companies and renewable energy firms are becoming more common, allowing for the sharing of infrastructure, knowledge, and resources. For example, offshore oil platforms are being repurposed to support offshore wind farms, creating synergies that benefit both industries.

4. The Shift Toward Green Hydrogen

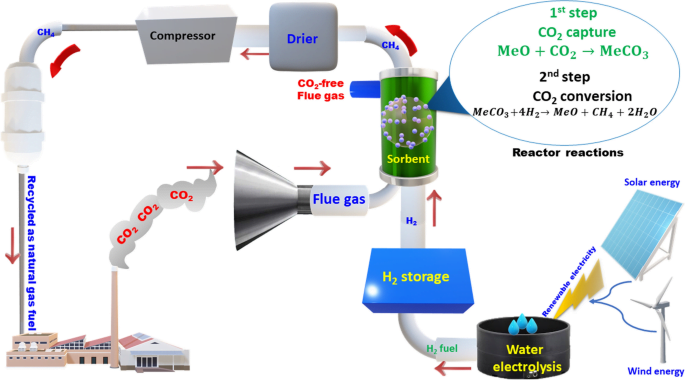

Hydrogen is emerging as a key player in the energy transition, and oil and gas companies are well-positioned to lead in its production. While traditional hydrogen production relies on natural gas, green hydrogen—produced using renewable energy sources—offers a low-carbon alternative. Oil and gas companies are increasingly investing in green hydrogen projects, seeing it as a way to remain relevant in a decarbonized future.

5. Electrification of Oil and Gas Operations

Renewable energy is not only being integrated into the global energy supply but is also being used to power oil and gas operations themselves. Electrification of upstream, midstream, and downstream processes using renewable energy helps reduce operational emissions. For instance, offshore platforms are now being powered by wind turbines and solar panels, contributing to the overall decarbonization of oil and gas production.

6. Renewable Energy as a Competitive Advantage

As governments around the world push for cleaner energy solutions and consumers demand more sustainable products, oil and gas companies are recognizing that adopting renewable energy is not just a compliance issue but also a competitive advantage. Companies that invest in renewable energy can position themselves as leaders in the energy transition, gaining favor with investors, regulators, and consumers who prioritize sustainability.

7. The Role of Government Policies and Regulations

Governments are playing a significant role in driving the shift toward renewables through stricter regulations on emissions and incentives for clean energy projects. Oil and gas companies are adapting by aligning with these policies, investing in renewable energy infrastructure, and complying with carbon pricing mechanisms. The European Union’s Green Deal, for example, is pushing energy companies to decarbonize and transition to greener energy sources.

8. Long-Term Energy Transition Strategies

Many oil and gas companies are developing long-term energy transition strategies to guide their shift from traditional fossil fuels to a more diverse energy portfolio. These strategies often include investments in renewable energy, low-carbon technologies, and sustainability initiatives, all aimed at reducing reliance on fossil fuels over time. While the full transition may take decades, the groundwork is being laid now.

9. Challenges and Opportunities

Despite the momentum toward renewables, the oil and gas industry faces challenges in making this transition. The shift requires significant capital investment, re-skilling of workers, and overcoming technical hurdles in integrating renewable technologies into existing infrastructures. However, the opportunity to lead in the global energy transition offers oil and gas companies a chance to reshape their future and secure long-term relevance.

Impact of Regulatory Changes

The oil and gas industry is currently experiencing a significant transformation due to the impact of regulatory changes driven by climate policies and international agreements aimed at reducing carbon emissions. Governments around the world are increasingly adopting stringent regulations to curb greenhouse gas emissions, which has resulted in profound implications for the operations of oil and gas companies. Compliance with these regulations often necessitates considerable investment in monitoring and reporting capabilities, elevating operational costs for businesses in this sector.

As climate policies evolve, oil and gas companies are compelled to reassess their strategies. This may include a pivot toward cleaner technologies, such as carbon capture and storage (CCS) and enhanced oil recovery (EOR) methods, which aim to minimize carbon footprints while meeting energy demands. The technological investments are not merely voluntary; rather, they are shaped by imminent regulatory pressures that mandate adherence to specific emissions targets. The interplay between regulation and investment catalyzes innovation within the industry, encouraging players to develop sustainable solutions that create a competitive advantage.

Additionally, these regulatory changes are inducing a shift in market dynamics. As consumers and investors increasingly favor sustainability, oil and gas companies are competing not only with each other but also with alternative energy providers. This evolving competition is compelling traditional energy firms to adopt hybrid models, integrating renewable energy sources into their portfolios. For instance, investments in wind or solar projects can serve as strategic maneuvers to comply with regulatory frameworks while simultaneously appealing to an environmentally conscious market.

Overall, the impact of regulatory changes is reshaping the trajectory of the oil and gas sector. Organizations must navigate the complex landscape of climate policies to remain viable and competitive. Secure compliance and proactive engagement with sustainable practices are becoming essential components of long-term success in an industry that is gradually aligning with global sustainability goals.

Technological Advancements in Renewable Energy

The landscape of renewable energy is continually evolving, driven by significant technological advancements that are having a profound impact on traditional oil and gas operations. Innovations in energy storage solutions have emerged as a game changer, allowing for the efficient capture and utilization of renewable sources such as solar and wind energy. These storage systems not only enhance grid reliability but also facilitate the integration of renewable energy into existing infrastructure, reducing dependency on fossil fuels.

Smart grid technology exemplifies another crucial advancement in the renewable energy sector. By utilizing digital communication technology, smart grids optimize the distribution and consumption of energy, ensuring that resources are used as efficiently as possible. This not only maximizes energy output from renewables but also minimizes waste, streamlining operations in the oil and gas industry that have traditionally relied on older, less efficient systems.

Additionally, the integration of artificial intelligence (AI) into renewable energy systems is revolutionizing how energy management occurs. AI algorithms can analyze vast amounts of data to predict energy demand, optimize supply chains, and streamline maintenance processes. Such insights not only improve operational efficiency but also significantly reduce costs associated with energy generation and distribution. The ability to anticipate fluctuations in energy supply and demand allows oil and gas companies to adapt more swiftly to market changes, aligning their operations with an increasingly renewable energy landscape.

These technological breakthroughs signify a critical shift towards a more sustainable energy future, showcasing how advancements in renewable energy are reshaping the oil and gas sector. By harnessing innovations in energy storage, smart grids, and artificial intelligence, the industry can not only enhance operational efficiency but also pave the way for a reduced environmental footprint, ushering in a new era of responsible energy consumption.

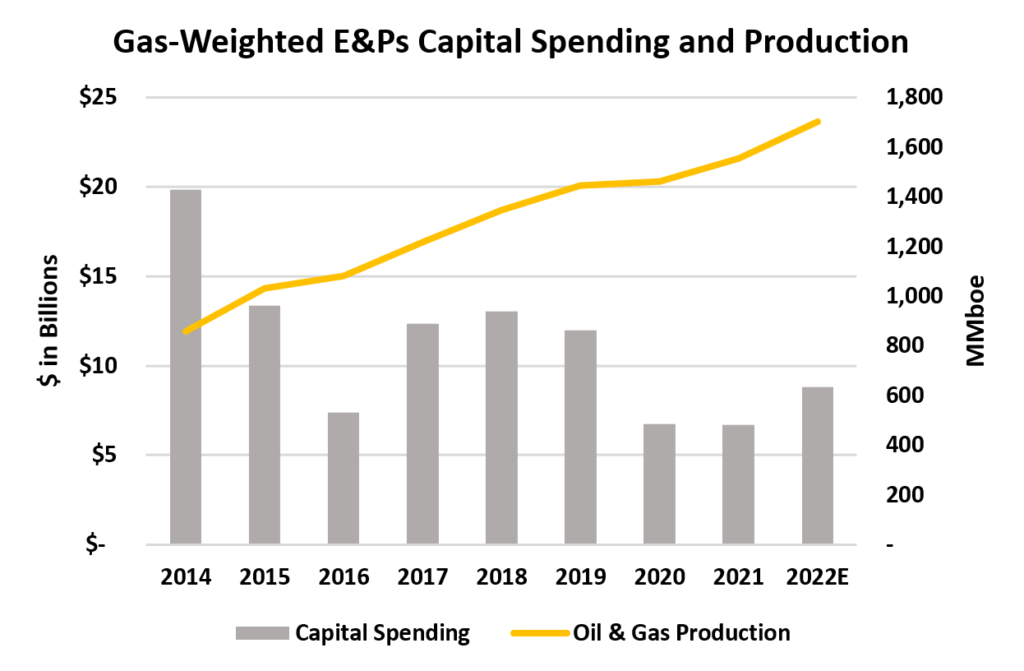

Investment Shifts Towards Renewables

The landscape of energy investment is currently experiencing a noteworthy transition, with considerable capital being directed towards renewable energy projects rather than fossil fuel endeavors. This shift is driven by several interrelated factors, including the accelerating climate crisis, governmental policies favoring sustainable energy, and evolving consumer preferences. Major oil and gas companies are re-evaluating their operational frameworks to align with these emerging energy trends, leading to diversification into renewable portfolios.

Significantly, energy firms such as BP and Shell have unveiled strategies to evolve from traditional oil and gas functions to integrated energy providers. BP, for instance, has committed to increasing its renewable energy investment from 10% to 40% of its total capital expenditures by 2030. This innovative approach does not only reflect a reaction to social demands for sustainability but serves as a proactive measure to mitigate financial risks associated with declining fossil fuel reliance. Furthermore, as oil prices remain volatile, the pursuit of reliable and long-term investment opportunities in renewables presents a compelling case for these energy giants.

Case studies of corporate giants serve to highlight the effectiveness of this shift. TotalEnergies, for example, has ramped up its investments in solar and wind projects, having allocated over $5 billion towards renewables in recent years. This strategic pivot toward renewable energy assets illustrates how traditional oil and gas companies can harness technological advancements and sustainability practices to remain competitive in the evolving energy market. Additionally, the increasing focus on corporate social responsibility is compelling these firms to prioritize investments that resonate with society’s expectations of environmentally friendly practices.

This progressive transition underscores a broader trend within the market, highlighting a significant paradigm shift in investment strategies where sustainability becomes synonymous with financial viability. As the industry continues to adapt, the future of oil and gas is undeniably linked with the advancement of renewable energy technologies.

Changing Consumer Preferences

The landscape of energy consumption is undergoing a significant transformation as consumer awareness and preferences increasingly lean towards greener options. Various surveys and studies reveal a palpable shift in public attitudes regarding energy usage and sustainability. For instance, a 2023 report from the International Energy Agency highlighted that over 70% of consumers are now prioritizing sustainable practices in their daily lives, demonstrating a clear demand for clean energy solutions.

Modern consumers are not just passive recipients of energy; they actively seek alternatives that align with their values. A survey conducted by Nielsen in early 2023 indicated that over 65% of participants were willing to pay more for products from companies committed to reducing their environmental impact. This trend is not only evident in consumer goods but is also reshaping how energy is produced and consumed. With the rise of renewable energy sources, such as solar and wind, consumers are gravitating towards providers that offer sustainable energy options.

This shift in consumer preference has prompted many companies in the oil and gas sector to reevaluate their strategies. Numerous firms are now investing in renewable technologies and exploring partnerships with clean energy innovators. For example, several major oil companies are reallocating a portion of their budget towards research and development in sustainable energy solutions, recognizing the long-term benefits associated with a green transition.

Furthermore, educational initiatives aimed at increasing awareness of climate change and energy sustainability are gaining traction. These campaigns aim to inform consumers about the environmental impact of traditional energy sources, further reinforcing the demand for cleaner alternatives. As public consciousness shifts towards sustainability, the traditional oil and gas industry must adapt to stay competitive and relevant in a rapidly evolving market.

Strategic Partnerships and Collaborations

In the evolving landscape of energy, the oil and gas industry is increasingly recognizing the importance of strategic partnerships with renewable energy firms. These collaborations serve as pivotal mechanisms to integrate innovative technologies and sustainable practices into traditional operations. With global energy demands undergoing a significant transformation, oil and gas companies are turning to joint ventures and research collaborations with sector-specific organizations to foster development and enhance their competitive edge.

One notable example is the partnership between BP and Ørsted, aimed at developing offshore wind projects. This strategic alliance underscores the potential for oil and gas companies to diversify their energy portfolios while leveraging the technical expertise of renewable energy leaders. By sharing resources, knowledge, and technological advancements, both entities can expedite the transition towards cleaner energy solutions, effectively addressing the dual challenge of meeting energy demands and reducing carbon footprints.

Moreover, collaborations often extend beyond joint ventures to include technology sharing agreements. These partnerships are essential not only for facilitating access to cutting-edge innovations but also for streamlining operational efficiencies. For instance, companies such as TotalEnergies have embarked on various technology-sharing initiatives focused on harnessing solar energy technologies, asserting their commitment to a more sustainable future.

Furthermore, research collaborations between oil and gas enterprises and universities or research institutes are producing groundbreaking advancements in renewable energy technologies. Such initiatives are vital for cultivating innovative approaches to resource extraction and energy generation. This synergy between traditional fossil fuel industries and renewable energy sectors illustrates a substantial shift in operational dynamics, leading to enhanced innovation and shared profitability.

In essence, the convergence of oil and gas companies with renewable energy firms exemplifies a strategic imperative in the quest for sustainable energy solutions. As these partnerships flourish, the industry is reshaping its trajectory, ultimately paving the way for a more holistic energy future.

Economic Implications for Oil and Gas Industry

The transition towards renewable energy sources is profoundly influencing the economic landscape of the oil and gas industry. As governments worldwide increasingly adopt sustainability goals and invest in clean technologies, the implications for traditional fossil fuel enterprises are both significant and complex. One primary effect is the shift in employment dynamics. As renewable energy sectors expand, there is a growing demand for skilled labor in areas such as wind, solar, and hydrogen technologies. This shift may lead to job displacement within the oil and gas sector, requiring a strategic workforce transition to mitigate potential economic risks. Companies in traditional energy sectors will need to invest in reskilling their workforce to align with emerging energy demands and reduce unemployment rates.

Moreover, the market valuation of oil and gas companies is increasingly influenced by investor sentiment shifting towards sustainability. As renewable sources gain traction, the perceived long-term viability of fossil fuels may diminish, causing fluctuations in stock prices and market capitalizations of oil and gas firms. Investors are becoming more cautious, often prioritizing environmentally responsible portfolios. This trend elevates the importance of incorporating sustainability practices into corporate strategies for these companies to maintain attractiveness to investors. Failure to adapt could result in declining valuations, further straining financial health.

Additionally, the decline of fossil fuels raises economic risks that warrant careful examination. As countries implement stricter emissions regulations and fossil fuel demand declines, there is the potential for economic upheaval in regions heavily reliant on oil and gas revenues. Governments must find pathways to diversify these economies and support affected communities. Such proactive measures are vital to minimize the adverse effects associated with the transitional phase towards a more sustainable economy.

Case Studies of Successful Transition

Numerous oil and gas companies have initiated strategic transitions towards renewable energy, illustrating how the industry can adapt to changing market conditions and environmental demands. A notable example is BP, which in recent years has committed to reducing its oil and gas output and increasing its investments in renewable energy sources. The company announced its strategy to achieve a significant reduction in its carbon emissions by 2030, alongside a goal of reaching a net-zero emissions target by 2050. BP has started investing billions into solar and wind projects, recognizing the potential for these renewable energy sources to play a critical role in their overall portfolio.

Another exemplary case is that of Shell, which has articulated its vision towards becoming a provider of clean energy solutions. Shell has increased investments in offshore wind farms and solar energy, demonstrating their commitment to transitioning away from traditional fossil fuel dependency. The company plans to reduce its oil production by around 1-2% per year, an ambitious move aimed to align with the global shift towards sustainability. By diversifying its energy portfolio, Shell aims to mitigate risks associated with fluctuating oil prices and regulatory pressures surrounding greenhouse gas emissions.

Equinor, a leading company in petroleum and wind energy, offers another compelling case study. Based in Norway, Equinor integrated renewable energy into its core operations by transitioning part of its offshore oil and gas investments into wind farms, particularly through the development of the Hywind project, which utilizes floating wind turbine technology. Equinor’s pioneering approach has resulted in a significant increase in renewable energy capacity while retaining its core oil and gas functionalities. These case studies provide essential insights and highlight that through strategic planning and investment in renewable projects, companies can successfully navigate the challenges of transitioning to a more sustainable energy future.

Conclusion: The Future of Oil and Gas in a Renewable World

As the global energy landscape evolves, the interplay between renewable energy and traditional oil and gas sectors becomes increasingly complex. Recent trends illustrate a undeniable shift toward sustainable energy solutions. While the oil and gas industry continues to play a crucial role in meeting the world’s energy demands, it must adapt to the growing prominence of renewable energy sources such as solar, wind, and hydroelectric power. The development of these technologies has led to a re-evaluation of traditional energy strategies, with an emphasis on integrating sustainable practices.

Several potential scenarios may shape the future of oil and gas in a renewable-centric environment. One possibility involves a gradual transition where fossil fuels serve as a bridge during the shift to 100% renewable systems. In this scenario, oil and gas companies would invest in carbon capture and storage (CCS) technology to mitigate their environmental footprint. Alternatively, embracing hybrid energy models could enable these companies to diversify their portfolios and invest in renewables, positioning themselves as energy providers in new markets.

Moreover, collaboration among industry stakeholders is essential for fostering innovation and enhancing synergies between renewable and fossil fuel sectors. This could accelerate the development of new technologies, regulations, and frameworks that support a more environmentally friendly approach to energy production. The adoption of policies focused on sustainability will also be pivotal in guiding the oil and gas sector toward a greener future.

Ultimately, the path forward for oil and gas in an increasingly renewable world hinges upon the industry’s commitment to evolve while remaining mindful of environmental impacts. By prioritizing sustainability and investing in cleaner technologies, oil and gas can continue to fulfill energy needs in a manner that aligns with global climate goals. The importance of a balanced energy strategy cannot be understated, as societies navigate the transition to a sustainable future.