Sustainable Investing

Sustainable investing represents a progressive approach to finance that integrates Environmental, Social, and Governance (ESG) factors into investment analysis and decision-making processes. This strategy emphasizes the long-term impact of investments on society and the environment, moving beyond the traditional focus on financial returns alone. By considering ESG factors, investors aim to support companies that prioritize sustainability and positive social impact, aligning financial objectives with ethical values.

The increasing recognition of climate change, social injustices, and corporate governance failures has led investors to seek ways to minimize risks associated with these global challenges. Sustainable investing is not merely a trend; it reflects a seismic shift in the financial landscape. Investors are becoming more aware of the fact that ESG factors can significantly influence company performance and overall economic stability. For example, companies with strong environmental practices often demonstrate better risk management and are more likely to achieve sustainable growth, making them attractive options for responsible investors.

Moreover, the adoption of sustainable investing principles is increasingly being driven by a younger generation of investors who prioritize ethical considerations alongside financial gains. With a growing demand for transparency and accountability, institutional investors are also incorporating ESG metrics into their processes. This change is not only shaping individual investment strategies but is also driving significant changes in corporate behavior as companies strive to meet the expectations of their stakeholders.

Overall, sustainable investing serves as a vital mechanism to address pressing global issues while generating returns. As the world grapples with the effects of climate change and social inequalities, the integration of ESG factors into investment strategies promises to offer a comprehensive framework for fostering resilience in financial markets.

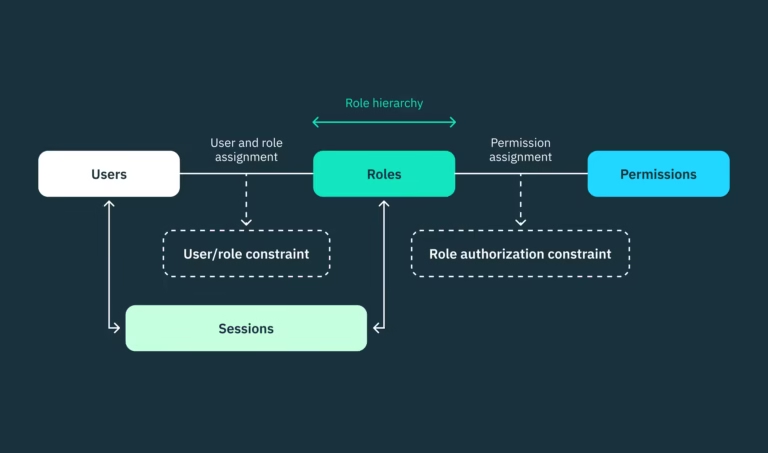

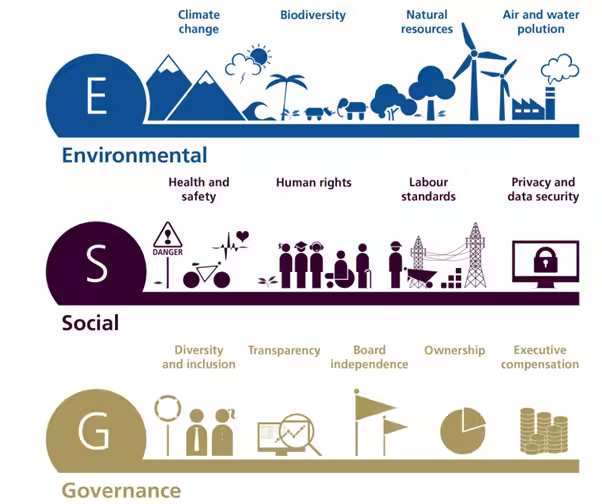

1. Understanding ESG Factors

Environmental, Social, and Governance (ESG) factors are critical components that investors consider when making investment decisions. These criteria help investors evaluate a company’s ethical impact and sustainability practices. Each aspect of ESG plays a unique role in shaping the overall investment landscape.

Environmental: The environmental factor assesses how a company performs as a steward of nature. This includes the company’s efforts to reduce pollution, manage waste, and address climate change. For instance, a corporation committed to renewable energy initiatives, reduced carbon footprints, and sustainable resource management can be seen favorably by investors focused on environmental responsibility. Companies that have robust environmental policies not only contribute positively to the planet but often realize cost savings in the long term, which can enhance shareholder value.

Social: Social criteria focus on a company’s relationships with its employees, suppliers, customers, and the communities in which it operates. It encompasses various aspects such as employee welfare, diversity and inclusion efforts, human rights practices, and community engagement. For example, a company that promotes a diverse workforce and actively supports local communities is likely to attract socially conscious investors who value corporate responsibility.

Governance: Governance factors pertain to the leadership and oversight structures of a company. Strong governance practices include transparent decision-making processes, accountability, ethical business practices, and diversified boards. Investors often scrutinize these factors to ensure that management aligns with the stakeholders’ interests. For instance, companies that demonstrate high levels of transparency and ethical conduct may be more appealing to investors, signaling a reduced risk of scandals or financial mismanagement.

As more investors embrace sustainable investing, the importance of ESG factors continues to rise. Understanding these criteria enables investors to make informed decisions, aligning their portfolios with their values while contributing to a more sustainable future.

2. The Rise of Sustainable Investing

Sustainable investing has emerged as a prominent trend in the financial landscape, marked by a significant shift in investment strategies over the past few years. The growing awareness of environmental, social, and governance (ESG) factors has led both individual and institutional investors to evaluate their portfolios through a more responsible lens. According to recent reports, global sustainable investment assets reached a staggering $35 trillion in 2020, reflecting a nearly 15% increase from the previous year. This upward trajectory illustrates the increasing importance of sustainable finance in shaping future investment decisions.

A key driver behind this rise is the changing consumer demand. As individuals become more environmentally and socially conscious, they are seeking opportunities that align not only with their financial goals but also with their personal values. Younger generations, in particular, prioritize sustainability, significantly influencing the market dynamics. Research indicates that millennials and Generation Z are more likely to choose brands and investment options that reflect their commitment to societal and environmental well-being.

Corporate responsibility has also played a crucial role in the rise of sustainable investing. Companies are now held accountable for their impacts on society and the environment, leading many to adopt responsible practices as part of their business models. Firms that prioritize ESG factors often experience enhanced brand reputation and customer loyalty, further motivating the shift toward sustainability in their operations. Additionally, legislative frameworks and political advocacy for sustainability have intensified, encouraging companies to disclose their ESG performance, thus providing investors with the necessary information to make informed decisions.

The convergence of consumer preferences, corporate accountability, and governmental influence signifies a transformative era in investment strategies. Sustainable investing is no longer merely a niche trend but rather a significant component of the modern financial ecosystem, shaping how capital is allocated in pursuit of both profit and purpose.

Historical Context

- The roots of sustainable investing can be traced back to the 1960s, when socially responsible investing (SRI) gained popularity as investors sought to avoid “sin stocks” in sectors like alcohol and tobacco.

- In the 21st century, the concept evolved, incorporating environmental and governance aspects, which laid the foundation for ESG as we know it.

Growing Investor Demand

- Recent data shows that ESG investments are seeing record inflows, with millennials and Gen Z investors leading the demand for sustainable assets.

- Institutional investors, including pension funds and endowments, are increasingly integrating ESG criteria as part of their fiduciary responsibilities.

Key Drivers of ESG Growth

- Climate Change and Environmental Awareness: The urgency to mitigate climate change has accelerated interest in environmental sustainability.

- Social Issues: Social movements like Black Lives Matter and MeToo have emphasized the importance of social responsibility in business.

- Corporate Accountability: High-profile corporate scandals have underscored the need for transparency and good governance, prompting investors to scrutinize corporate behaviors.

3. Impact of ESG on Financial Performance

As sustainable investing continues to gain traction, the impact of Environmental, Social, and Governance (ESG) factors on financial performance has become a topic of significant interest among investors and scholars alike. Numerous studies have explored the correlation between ESG performance and financial metrics, with findings suggesting that integrating ESG factors into investment strategies may bolster returns. Research from various academic institutions and financial analysts indicates that companies demonstrating strong ESG practices tend to outperform their counterparts in several key areas.

One notable report by MSCI found that firms with high ESG ratings often exhibit lower capital costs and improved credit ratings, which can lead to enhanced profitability and reduced risk. This observation aligns with the generalized belief that ESG-conscious companies are better equipped to manage regulatory and reputational risks that arise from environmental and social challenges. Moreover, studies have shown that sustainable investments can yield competitive returns, particularly in volatile markets where ESG factors serve as indicators of resilience.

Furthermore, a comprehensive meta-analysis conducted by the University of Hamburg revealed a statistically significant positive correlation between ESG performance and corporate financial performance, suggesting that investors who prioritize sustainability could benefit financially. Increasingly, institutional investors are reallocating assets to capitalize on ESG investments, further reinforcing a shift towards sustainable investing practices.

In the context of growing consumer awareness and preference for socially responsible products, firms that prioritize ESG principles are likely to experience enhanced brand loyalty and market share. Consequently, integrating ESG metrics into investment analyses is no longer simply a matter of ethical considerations but also a strategic approach to optimizing financial performance.

How ESG Factors Influence Investment Strategies

Portfolio Construction with ESG

- ESG integration has become a core aspect of portfolio construction, impacting asset allocation and sector weighting.

- Investment managers use ESG data to identify companies with sustainable practices and avoid those with high ESG risks, leading to diversified portfolios that also align with investors’ values.

Impact of ESG on Asset Classes

- Equities: ESG factors are crucial in equity analysis, where sustainable practices can indicate long-term viability.

- Fixed Income: Green bonds and social bonds allow investors to contribute directly to environmental and social projects.

- Private Equity and Venture Capital: Startups focusing on sustainable solutions are attracting venture capital, providing new growth avenues.

Benefits of Sustainable Investing

Financial Performance

- Studies indicate that companies with strong ESG practices often exhibit better financial performance over time, including higher returns and lower volatility.

- ESG investments can reduce portfolio risk, as companies prioritizing sustainability may be better prepared for future challenges.

Risk Management

- ESG considerations help investors mitigate potential risks like regulatory fines, reputational damage, and supply chain disruptions.

- Environmental and governance factors, in particular, can protect against catastrophic risks related to climate change and governance failures.

Enhanced Long-Term Value

- ESG-focused companies often foster better employee satisfaction, customer loyalty, and operational efficiencies, which can drive long-term value creation.

- Investors increasingly view ESG as a pathway to creating sustainable, enduring wealth.

4. Challenges in ESG Investing

Sustainable investing, particularly the incorporation of Environmental, Social, and Governance (ESG) factors, is increasingly gaining traction. However, the integration of ESG metrics into investment strategies is fraught with challenges that can hinder their effectiveness and acceptance among investors. A notable concern within the ESG landscape is the phenomenon of greenwashing. This term refers to the practice where companies exaggerate or misrepresent their commitment to sustainable practices to appear more environmentally friendly than they are. As investors become more aware and cautious, greenwashing undermines the credibility of genuine ESG efforts, creating skepticism about the authenticity of corporate claims.

Another significant challenge is the lack of standardized metrics for evaluating ESG performance. Unlike traditional financial metrics, which are well-established and regulated, ESG metrics vary widely across organizations and sectors. This inconsistency complicates the comparison of different investments and may lead to confusion among investors. The absence of universal standards also means that companies can pick and choose which aspects of ESG they wish to highlight, potentially skewing the investment decision-making process. As a result, investors may struggle to accurately assess the ESG credentials of potential investment opportunities.

Moreover, measuring the true impact of ESG practices on financial performance poses a complex challenge. While numerous studies suggest a positive relationship between high ESG scores and superior financial outcomes, the causal links are not always clear. Various external factors can influence financial performance, making it difficult to isolate the specific effects of ESG initiatives. Consequently, investors may find it challenging to align their financial goals with their commitment to sustainable investing, leading to uncertainty about the overall efficacy and consequences of incorporating ESG factors into their investment strategies.

Greenwashing

- Some companies engage in “greenwashing” by overstating their ESG achievements to appeal to investors, leading to potential ethical and financial issues.

Lack of Standardization

- ESG lacks global regulatory standards, resulting in discrepancies across regions and sectors, complicating comparisons for investors.

Balancing Returns with Impact

- Some critics argue that prioritizing ESG may limit returns, as it sometimes restricts investment opportunities in profitable, non-sustainable industries.

Data and Reporting Issues

- ESG reporting can be inconsistent and hard to verify, creating challenges for investors seeking transparency.

5. ESG Integration in Investment Strategies

As sustainable investing continues to gain traction, more investors are recognizing the importance of integrating Environmental, Social, and Governance (ESG) criteria into their investment strategies. This approach allows investors not only to pursue financial returns but also to align their portfolios with their values and societal goals. Various methods have emerged that enable investors to incorporate ESG considerations into their investment decision-making processes.

One common approach is negative screening, which involves excluding companies or sectors that do not meet specific ESG standards. For example, investors may choose to avoid investing in industries such as fossil fuels or tobacco, thereby reflecting their commitment to sustainability. This method allows investors to filter out those entities that do not align with their ethical considerations. However, it often leads to a narrower investment universe, which may impact diversification and overall performance.

On the other hand, positive screening emphasizes identifying and investing in companies that excel in ESG performance. This strategy involves selecting firms that demonstrate strong sustainability practices, ethical labor policies, or robust governance structures. By focusing on these leaders, investors aim to support organizations that contribute positively to society while potentially tapping into long-term growth prospects associated with well-managed companies.

Moreover, ESG integration within traditional investment frameworks entails embedding ESG analysis directly into the existing financial evaluation processes. This holistic approach evaluates both traditional financial metrics and ESG factors, allowing investors to gain a complete understanding of the risks and opportunities presented by potential investments. By using tools such as ESG ratings and research, investors can make more informed decisions, balancing return expectations with sustainability considerations.

Overall, integrating ESG criteria into investment strategies reflects a growing acknowledgment of the interdependencies between financial performance and sustainable practices. As awareness increases, more investors are likely to utilize a mix of these approaches, ultimately driving significant changes in the investment landscape.

Negative Screening

- Avoiding companies with poor ESG records or involvement in controversial industries like fossil fuels, tobacco, and firearms.

Positive Screening

- Investing in companies or industries with high ESG performance, such as renewable energy and fair-trade companies.

Thematic Investing

- Focusing on specific ESG themes like clean energy, gender equality, or water conservation.

Impact Investing

- Directing capital toward projects and companies aiming to generate measurable social and environmental impact alongside financial returns.

Engagement and Shareholder Activism

- ESG investors increasingly use their influence as shareholders to push companies toward more sustainable practices, voting on corporate policies or joining coalitions to drive change.

6. Case Studies of Successful ESG Investments

Real-world examples of successful ESG investments highlight how integrating environmental, social, and governance factors can enhance financial performance while promoting sustainability. One prominent case is the investment strategy employed by the CalPERS (California Public Employees’ Retirement System). This pension fund has made significant strides in implementing ESG factors within its portfolio, underscoring the transformative effects of sustainable investing. By prioritizing companies that exhibit strong governance practices and commit to reducing their carbon footprint, CalPERS has not only diversified its investments but also demonstrated a consistent performance that aligns with its long-term objectives.

Another example can be drawn from the BlackRock investment firm, which has fully embraced the ESG paradigm. BlackRock’s dedicated ESG fund portfolio has seen substantial growth, attracting billions in capital. Their approach highlights companies that are leaders in their respective sectors regarding sustainability practices and social responsibility. By focusing on these investments, BlackRock has positioned itself to navigate market volatility effectively, while also encouraging its portfolio companies to enhance their ESG commitments.

The Unilever corporation presents a compelling case of how a consumer goods company has thrived by embracing sustainable business practices. Unilever’s Sustainable Living Plan integrates ambitious sustainability goals into its business model, aiming to reduce its environmental impact while enhancing social equity. This dedication has resulted in both improved brand loyalty and financial performance, showcasing that integrating ESG principles can yield significant returns for shareholders.

These case studies illustrate the growing influence of ESG factors in shaping successful investment strategies. As more investors recognize the importance of sustainability and ethical governance, the trajectory of investment performance is being positively impacted, suggesting a promising future for ESG-focused investments.

7. Regulatory Environment and ESG Disclosures

The regulatory environment surrounding Environmental, Social, and Governance (ESG) disclosures has evolved significantly in recent years. Governments and regulatory bodies worldwide have recognized the importance of enhancing transparency and accountability regarding corporate practices related to ESG factors. This shift has led to the implementation of stricter regulations aimed at improving the quality and consistency of ESG reporting among companies. As a result, many organizations are now required to disclose a comprehensive range of ESG-related information, providing investors with a clearer and more standardized framework for assessing potential investments.

In regions such as the European Union, the introduction of the Sustainable Finance Disclosure Regulation (SFDR) has set a new benchmark for sustainability reporting. This regulation mandates financial market participants to integrate ESG risks and impacts into their investment decision-making processes. Similarly, in the United States, regulatory bodies like the Securities and Exchange Commission (SEC) have begun to assess how companies communicate their ESG practices and risks to their shareholders. These developments reflect a growing acknowledgment that investors require robust ESG disclosures to make informed decisions, ultimately influencing capital allocation toward more sustainable enterprises.

Moreover, the role of regulatory bodies extends beyond merely establishing frameworks for ESG disclosures. They also play a crucial part in pushing for consistency and comparability across different sectors and markets. This entails establishing guidelines that help companies report their ESG performance in a transparent manner. These regulations encourage firms to align their practices with international standards, thus fostering a more accountable and sustainable investment environment. As sustainability becomes increasingly integral to the investment landscape, the dialogue between regulatory authorities and companies will likely continue to evolve, shaping the future of investment strategies driven by ESG considerations.

Regional Differences in ESG Policy

- United States: The U.S. has relatively few mandatory ESG disclosures, though companies are increasingly adopting voluntary standards.

- European Union: The EU leads in ESG regulation with initiatives like the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy for sustainable activities.

- Asia: ESG integration is growing rapidly, particularly in Japan and China, driven by a mix of government policies and investor demand.

8. Future Trends in Sustainable Investing

As the global focus on sustainability intensifies, the landscape of sustainable investing is undergoing considerable transformation. One of the most prominent trends is the increasing awareness among consumers regarding environmental, social, and governance (ESG) factors. This heightened consciousness is prompting investors to actively seek out investment opportunities that align with their values. Consumers are more informed than ever, often utilizing resources and platforms that provide insight into a company’s sustainability practices, thereby influencing market demand for responsible investment options. As a consequence, companies are increasingly held accountable for their impact on society and the environment, leading to more robust corporate sustainability strategies.

Another significant trend shaping the future of sustainable investing is the integration of technology in ESG assessment. Innovative tools and platforms are emerging that facilitate the analysis of ESG data, enabling investors to make more informed decisions. Machine learning and artificial intelligence are being harnessed to evaluate vast datasets, enhancing the accuracy and efficiency of sustainability metrics. This technological progression not only streamlines the investment process but also ensures that investors have access to real-time information about a company’s ESG performance. As financial institutions and asset managers leverage these advancements, the emphasis on data-driven decision-making will likely redefine investment strategies in the realm of sustainable finance.

Additionally, the influence of millennials and Generation Z cannot be underestimated in the realm of sustainable investing. These younger generations prioritize sustainability, often opting for investments that reflect their commitment to social responsibility and ecological stewardship. As they begin to inherit wealth and take on roles as decision-makers, their preferences are likely to push investment firms toward adopting greener practices. This generational shift highlights a broader societal trend where sustainability becomes not just an ethical consideration but also a determinant of financial performance. As such, embracing sustainable investing will not only be a moral imperative but also a viable strategy for securing future capital.

Rise of Climate-focused Investments

- With climate change becoming a global priority, climate-focused investments, like carbon-neutral portfolios and green bonds, are expected to grow.

Technology Integration in ESG

- AI and big data analytics are helping investors make better ESG assessments, enhancing data accuracy and predictability in sustainable investing.

Growth of Socially Conscious Millennials and Gen Z

- As younger generations with strong social values enter the investing world, ESG demand will likely continue to rise, influencing corporate behavior and market trends.

Emphasis on Diversity and Inclusion

- Social aspects of ESG are gaining attention, with investors focusing on companies that prioritize diversity, equity, and inclusion.

Potential for Global Standardization

- The push for a global ESG standard is strong, and organizations like the International Financial Reporting Standards (IFRS) are working toward unified guidelines.

9. Steps for Investors to Begin Sustainable Investing

Define Personal ESG Goals

- Investors should clarify what ESG factors matter most to them, whether environmental impact, social responsibility, or ethical governance.

Research ESG Investment Options

- Exploring various options such as ESG-focused ETFs, mutual funds, and direct company investments can help investors align portfolios with their values.

Understand ESG Ratings

- Familiarity with ESG ratings and their limitations is crucial for making informed investment decisions.

Stay Informed on Regulatory Changes

- Keeping up with evolving ESG regulations and trends can help investors adjust strategies accordingly.

Regularly Review Portfolio

- As ESG ratings and company behaviors shift, a regular portfolio review ensures alignment with both financial and sustainability goals.

Conclusion

The rise of ESG and sustainable investing reflects a broader shift in financial markets toward responsible, values-driven investment strategies. ESG factors are no longer optional considerations; they are essential to long-term risk management, profitability, and reputation. As we move forward, sustainable investing is expected to grow, driven by technological advancements, evolving investor expectations, and potential global regulatory standards. For those looking to align their financial goals with a positive impact, ESG investing presents a rewarding opportunity, shaping a future where profit and purpose go hand in hand.